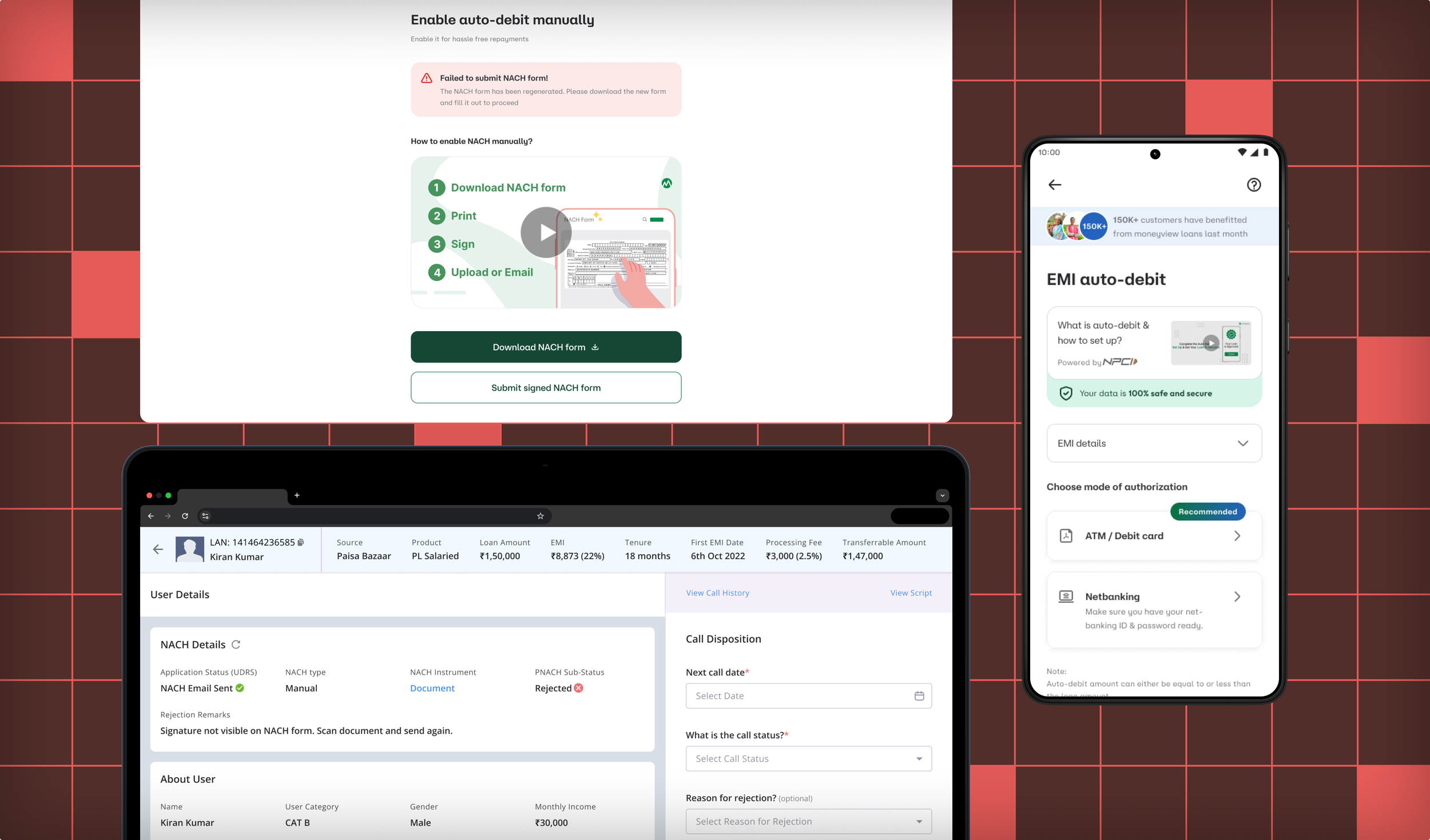

Auto-Debit Setup

CRM redesign reduced on-call support time by 39%, freeing up operations teams and improving customer-facing conversions.

Business Impact

This project delivered the following value:

Reduced customer on-call auto-debit support time by 39%, freeing up bandwidth for cross-functional teams.

Increased auto-debit conversions by 13% by streamlining internal CRM tools and simplifying the customer-facing setup flow.

Enhanced internal workflows, reducing friction for support agents and accelerating issue resolution.

The Objective

Moneyview wanted to improve conversion at high-intent steps, and customers signing the auto-debit stage was one of them. Both the internal CRM used by support agents and the customer-facing setup flow—to reduce friction in auto-debit activation.

The goal was to drive higher conversion rates and reduce dependence on support calls by making processes more intuitive for agents and users alike.

We didn’t want to strip the users of support, but ease their mental model to adopt, so we executed the project in a phase-wise approach.

Understanding the Problem

Support agents needed a tool with relevant customer information to connect with customers and convert them by making them setup auto-debit setups.

While over the long term, customers needed a clear, intuitive flow that enabled them to set up auto-debits quickly and confidently, without needing agent assistance.

Challenges

The Existing CRM tool flooded agents with a plethora of information, mostly redundant. Because of this, agents were forced to develop a mental model of repetitive manual steps, increasing call duration and reducing efficiency.

Customers struggled to complete the auto-debit activation independently because of confusion, lack of clarity and some technical constraints, leading to increased call volumes and reduced conversions.

Integrating improvements into the current system from one side is achievable, but signing auto-debit mandates is on a third-party platform. So, partner-side improvements were necessary to eliminate disruptions to existing functionalities that posed significant design and technical challenges.

Research Phase

Shadowed support agents through their workflows to understand pain points and logged call durations.

Studied customer support tickets to identify customer comments and issues.

Surveyed customers to identify setup issues and reasons for drop-offs.

Mapped task flows and user journeys to surface and resolve inefficiencies and ambiguous interaction points.

Developed agent and customer personas with a focus on motivations, blockers, and constraints.

Design Phase

Phase 1:

Sketched out revised CRM screens for agents.

Designed prototypes with improved information architecture, hierarchy and design to reduce cognitive load.

Facilitated alignment sessions with product, engineering, and operations teams to validate feasibility and prioritise solutions.

Studied and captured feedback from agents through a task-based unmoderated usability test.

Phase 2:

Created low-fidelity wireframes for a simplified auto-debit setup flow for customers.

Prototyped solutions with improved learning experiences to educate and assure users.

Continued prototyping to address technical constraints while keeping the user experience at the forefront.

Monitored interactions and funnel health, measuring completion time, error rates, and support call reductions post-launch and drew up a plan for iterative improvements.

Learnings

Improving agent efficiency had a direct, measurable impact on customer success metrics.

Early buy-in from operations and support teams enabled faster rollout and smoother transitions.